Author: Blue Sky

Capital Gains Tax in France

Tax Overview

Capital gains tax – impôt sur les plus values – is a tax payable in France on gains arising from the sale of land or properties. Capital gains are calculated as the difference between the sale price and the purchase price or the value that was reported when the property was received as a gift or by inheritance. Rules governing capital gains tax vary in accordance with the sale price, the nature of the asset, the country of residence of the seller and how long the asset has been held. Capital gains made on the sale of assets are exempt when the sale price is under €15,000. Sale of a principal residences are totally exempt, regardless of how long the property had been owned. Capital gains achieved on properties sold when the property has been owned for 30 years or more are also exempt. In other cases, the vendor is liable to pay tax and social security charges (CSG, CRSG) on the net capital gains.

To calculate the amount of net capital gains, Gross Capital Gains can be adjusted by the following factors:

Deductible expenses

Home improvement expenses (extension, double glazing, new kitchen etc) are deductible from the sale price as long as the vendor has kept invoices and proofs of payments and has not already deducted these expenses for other purposes. Alternatively, the vendor may use a flat rate deduction equal to 15% of the purchase price. To be eligible, the vendor must have owned the property for at least five years. Sale fees can also be deducted from the sale price. These may include the costs incurred to complete the mandatory certificates and surveys (eg Energy Performance Certificate) as well as the fees the fiscal representative may charge.

Purchase fees

Fees including stamp duties, notary and agent fees which were incurred when buying the property can be added to the purchase price. By default a flat rate of 7.5% of the purchase price can be used.

Taper relief

This is effectively an allowance for the duration of ownership.

Taper relief for tax purposes:

6% for the sixth to the 21st year of ownership;

4% for the 22nd year

Taper relief for social charges purposes:

1.65% for the sixth to the 21st year

1.60 % for the 22nd year

9% for the 23rd to the 30th year

Tax and social security rates :

Income tax rate applicable to Capital Gains Tax stands at 19%

In addition, social charges of 17.2% apply to Capital Gains Tax.

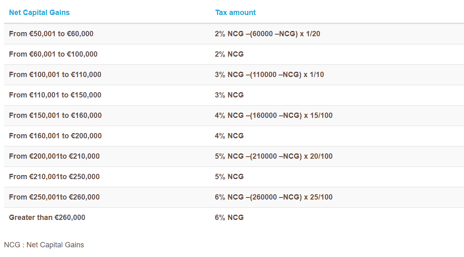

Additional taxes are also levied when net Capital Gains are greater than €50,000. Additional taxes payable are calculated as follows:

Should you remortgage to take advantage of lower rates?

With French mortgage rates dropping to all-time lows, now can seem the perfect time to remortgage. But before you start the process of looking for bank statements and pay slips, here are a few guidelines to help you assess whether it makes sense to refinance the loan you took out to buy your French home.

1. Remortgage if you can minimise your total cost of borrowing. Switching mortgage provider in France is not as smooth as it can be in the UK. In addition to the administrative process, refinancing involves fixed and variable fees. All in all, legal fees, early repayment charges and administrative costs will account for about 5% of the loan amount. It is therefore important to look beyond interest rates.

As a rule of thumb, re-mortgaging will make sense and will save you money if:

– The rate you are currently on is 1% higher than the new rate you are offered;

– You are closer to the beginning than the end of your existing mortgage loan;

– Your outstanding balance is higher than €50,000.

Finally, as lenders require mortgage protection insurance, you will need to consider the cost of a new policy, particularly if you have new or pre-existing medical conditions.

2. Remortgage to raise capital If you have equity in your home or don’t have a French mortgage, it may be worth contemplating taking cash out in addition to re-mortgaging. Borrowing against your French property can be a very effective way of raising capital, financing renovation work, or repaying more expensive debts either in France or in the UK.

3. Remortgage to switch to a fixed rate loan

If you intend to keep your French property for the years to come, a low rate environment can be a perfect time to move from a tracker to a long term fixed rate mortgage. Similarly, if you are on an interest only deal, it may be worth remortgaging to avoid early repayment fees and to anticipate the amortization period.

In any case, an authorised mortgage broker will be able to assist you with exploring options and recommend a product suitable for your needs.

Should you refinance your French mortgage to take advantage of better rates ?

With French mortgage rates dropping to all-time lows, now can seem the perfect time to remortgage. But before you start the process of looking for bank statements and pay slips, here are a few guidelines to help you assess whether it makes sense to refinance the loan you took out to buy your French home.

1. Remortgage if you can minimise your total cost of borrowing. Switching mortgage provider in France is not as smooth as it can be in the UK. In addition to the administrative process, refinancing involves fixed and variable fees. All in all, legal fees, early repayment charges and administrative costs will account for about 5% of the loan amount. It is therefore important to look beyond interest rates.

As a rule of thumb, re-mortgaging will make sense and will save you money if:

– The rate you are currently on is 1% higher than the new rate you are offered;

– You are closer to the beginning than the end of your existing mortgage loan;

– Your outstanding balance is higher than €50,000.

Finally, as lenders require mortgage protection insurance, you will need to consider the cost of a new policy, particularly if you have new or pre-existing medical conditions.

But it can be worth it ! A borrower who took out 20 year €200,000 mortgage at a rate of 4% in 2011 would save €9.182, net of fees, if he remortgaged on a 2.9% deal without increasing the term.

2. Remortgage to raise capital If you have equity in your home or don’t have a French mortgage, it may be worth contemplating taking cash out in addition to re-mortgaging. Borrowing against your French property can be a very effective way of raising capital, financing renovation work, or repaying more expensive debts either in France or in the UK.

3. Remortgage to switch to a fixed rate loan

If you intend to keep your French property for the years to come, a low rate environment can be a perfect time to move from a tracker to a long term fixed rate mortgage. Similarly, if you are on an interest only deal, it may be worth remortgaging to avoid early repayment fees and to anticipate the amortization period.

In any case, an authorised mortgage broker will be able to assist you with exploring options and recommend a product suitable for your needs.